How Long Does it Take to Buy a House?

Your home loan does not have to take a long time. Find out how you can speed up the process.

Your home loan does not have to take a long time. Find out how you can speed up the process.

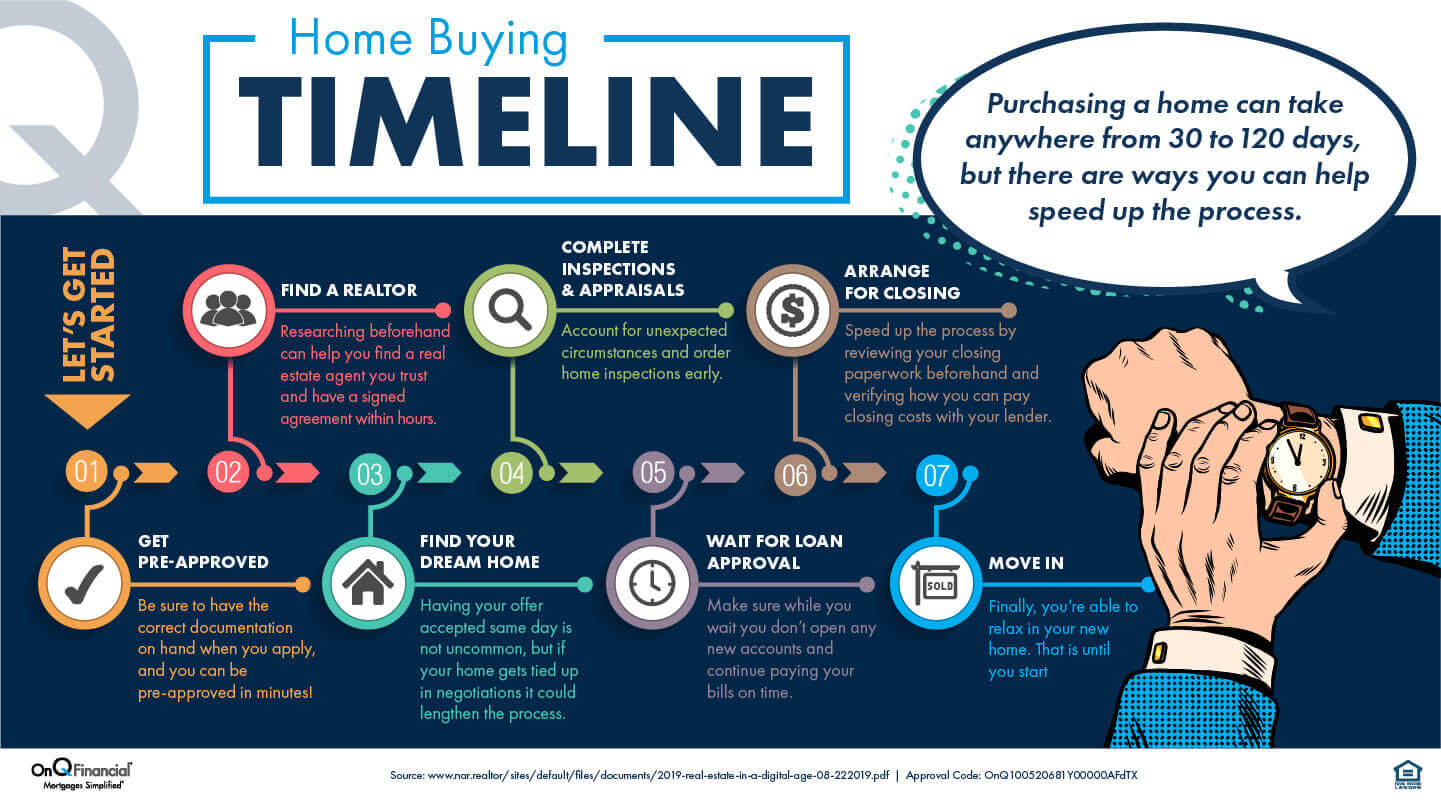

Home purchases can take anywhere from 30-120 days, although months-long closings are usually the exception. However, there are some strategies you can use to shorten your close to as little as one week! Keep in mind that many of the steps in this guide happen concurrently, so timelines will vary.

An essential step of home buying is securing funding. Because a house purchase is one of the largest transactions you can make, ensuring you can pay for it becomes a crucial question. Although you can pay for a house in many ways, the most common is mortgage or cash.

Securing a mortgage can come with a bit of anxiety, especially when the process takes so long, but you can minimize this stress by ensuring you are prepared. Here is a list of documents to have ready when you start your mortgage application.

Most Recent Pay Stubs (Two recent Pay Stubs)

Pre-approval usually only takes a couple of days and is necessary for buying a home with a mortgage. However, if you are buying with cash, you may be able to put an offer on a house without pre-approval.

Making use of your lender’s online options can make this a speedy process.

We recommend setting up a file or digital folder of your required documents so that you can send all of your documents quickly.

A pre-approval letter will show you are serious about buying a home, and your real estate agent will likely ask you to have one before seriously looking for a home. Having a pre-approval will also mean that your application file is prepared and waiting to be officially submitted, meaning a faster approval later on. You might even save time later if your lender uses upfront underwriting.

Finding the right realtor can make a big difference in the time it takes to close on your home. Once you find a realtor you trust, they will often ask you to sign a contract, sometimes called a buyer’s agent agreement. Because realtors and real estate agents work on commission, they reasonably want to ensure you will not switch to another agent at the last minute after they have already done the work.

The contract will specify how long you will exclusively work with this agent, usually six months to one year. Be sure to note how long that is. If you are unsatisfied with your realtor, you can ask them to cancel the contract, and you can begin your search once again. However, we recommend picking the right agent in the first place as that will help reduce the time it takes to buy your new dream house.

Once you have found your dream home, you will put in an offer. Your real estate agent will take the lead here and write up a contract. If it took you a long time to find a house you love, you would want to ensure you put in an enticing offer. A strong offer will not only ensure you secure the house of your dreams, but it will also reduce the time it takes to buy your home.

This is also when your pre-approval comes into play. Once you have made the offer, your lender will begin your loan origination. On Q Home Loans will work tirelessly to ensure you meet the closing date in your contract.

In the meantime, your inspection period will begin, and you will need to move quickly.

To determine whether your chosen home is a worthwhile investment, you may have state-required inspections. While a home inspection and appraisal are necessary for most home loans, buying in cash means you may only need to fulfill state requirements.

However, we recommend you complete all inspections and to be present for them. This will ensure that you have an understanding of any issues and can communicate this to your agent. Inspections themselves will only take about an hour, but scheduling the appointments can be tricky, especially if you have a lot, so keep that in mind.

The appraisal usually occurs at the beginning of the inspection period and is normally ordered by your lender. It usually takes an average of 3 to 10 days to complete and receive the appraisal once it is ordered.

Knowing the value of the home you are buying can be incredibly beneficial when it comes to negotiations. Just remember that negotiating could increase the time to close on your home and potentially lose the bid entirely.

Your prospective home’s value also determines whether the property is a worthwhile investment for your lender. A house worth much less than the loan amount may complicate your mortgage. At On Q Home Loans, we will work with you every step of the way to make sure your process is simple!

There is not much you will be required to do during this time, aside from signing any documents your lenders will require. Take this time to relax, take a breath, and make sure you do not make any large purchases or take on new debt. Changes in your credit profile could prolong the process or cause your loan to be denied.

Here are the average close times for some common programs:

If you are using a streamlined product or your lender uses an automated underwriting system, your loan review may be completed sooner. Once it has been reviewed, you will receive a closing disclosure or, in some cases, a conditional approval. Conditional approvals will extend your time, but your lender will outline what you need to do to close your loan.

Soon after your loan is approved, you will receive your closing disclosures and will be ready to close on your home. This process usually takes less than a week. You will need to review your closing disclosures before your final paperwork signing with a notary during this time.

Before you close, you are also entitled to a final walkthrough. We recommend you take your time on the final walkthrough as this is your last chance to make any last-minute decisions or review any work that was agreed upon in your contract. Note that any additions or issues at this stage will prolong your closing.

Your signing is a momentous part of the process, as it makes everything you have worked for during your process official. The meeting may include your real estate agent or any attorneys involved in your purchase. When this meeting takes place is usually outlined in your purchase contract and will be a day or two before your closing date to ensure you close on time. At On Q Home Loans, your closing date is guaranteed* as we are committed to making your home buying experience simple!

Buying a house with cash instead of through a mortgage can speed up the closing time significantly. In cash scenarios, you will only need to wait for any inspections or appraisals you request. Because you do not have a lender, you will only need to satisfy state or local requirements.

Cash offers are also extremely competitive as sellers will receive their funds almost immediately.

However, saving enough money for an all-cash offer is a considerable challenge for most people. While cash offers have some inherent benefits, it is not reasonable to save the amount required using traditional methods.

Instead, it is more feasible to save for a hefty down payment and finance the rest of your mortgage. This will put you in a good position with your lender and not take as long as saving for the entire amount.

In fact, with down payment assistance programs and the various loan options that On Q Home Loans offers, you might be surprised to learn that you may not need to have thousands saved before making your dream a reality.

Now that you have an idea of how long your process will take, continue on your Home Buying Journey to learn pre-approval and why it’s one of the most critical steps towards buying your Dream Home.

Next Step: How to Get Pre-Approved